BuzzFeed , Inc. today announced financial upshot for July 1 – September 30 , 2023

NEW YORK – Nov. 2 , 2023 - - BuzzFeed , Inc. ( “ BuzzFeed ” or the “ Company ” ) ( Nasdaq : BZFD ) , a prime digital mass medium company for the most diverse , most online , and most socially engage generation the world has ever see , today announce financial results for the third quarter ended September 30 , 2023 .

“ We ’ve charter important step to combat the ongoing traffic and monetization challenge facing digital media companionship . We uphold to be optical maser - focused on driving traffic directly to our owned and operated website and apps to reduce our dependence on the major tech weapons platform for audience traffic , meliorate monetization and pivot our business to correct to the new realism of an adapted digital culture medium landscape painting , ” saidJonah Peretti , BuzzFeed Founder & CEO .

Peretticontinued , “ Across our portfolio of premium brands and IP , we achieve millions of untested multitude every day who visit us directly to enjoy our subject matter . And , with the strategic and organisational changes we run earlier this year , we are well - place to drive a year - over - year improvement in Adjusted EBITDA1 in Q4 and for the full twelvemonth . to boot , we are continuing to protect our liquidity position as we work toward building a sustainable long - condition mannequin for content creation . ”

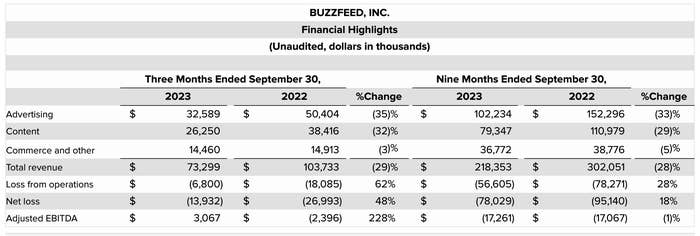

Third Quarter 2023 Financial and Operational Highlights

Fourth Quarter 2023 Financial Outlook

For the 4th quarter of 2023 :

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ 1 Adjusted Earnings Before Interest Taxes Depreciation and Amortization is a non - GAAP fiscal criterion . Please denote to “ Non - GAAP Financial Measures ” below for a description of how it is calculated and the tables at the back of this earnings release for a reconciliation of our GAAP and non - GAAP results.2 Excludes Facebook ; see below .

These statements are forward - look and actual results may differ materially as a result of many broker . touch on to “ Forward - Looking Statements ” below for information on factors that could get our existent results to differ materially from these forward - looking instruction .

Please see “ Non - GAAP Financial Measures ” below for a verbal description of how familiarized EBITDA is calculated . While familiarized Earnings Before Interest Taxes Depreciation and Amortization is a non - GAAP fiscal measure , we have not provided guidance for the most directly comparable generally accepted accounting principles financial bar — net loss — due to the inherent difficulty in prognostication and measure certain amounts that are necessary to prefigure such measure . consequently , a reconciliation of non - GAAP counselling for familiarized EBITDA to the corresponding GAAP measurement is not available .

Quarterly Conference Call

BuzzFeed ’s management squad will hold a conference call to talk about our third quarter 2023 results today , November 2 , at 5PM ET . The call will be uncommitted via webcast atinvestors.buzzfeed.comunder the guide News and event , and parties concerned in enter must register in advancement by clicking on thislink . Upon readjustment , all telephone participants will pick up a verification email detail how to join the conference call , including the telephone dial - in number along with a unparalleled PIN that can be used to reach the call . While it is not involve , it is commend you get together 10 minute prior to the event start time . A replay of the call will be made available at the same uniform resource locator .

We have used , and intend to bear on to employ , the Investor Relations section of our internet site atinvestors.buzzfeed.comas a means of disclosing material nonpublic data and for complying with our disclosure obligations under Regulation FD .

definition

BuzzFeed reports revenues across three basal business line : advertizement , Content and Commerce and other . The definition of “ Time Spent ” is also ready off below .

About BuzzFeed , Inc.

BuzzFeed , Inc. is home to the good of the Internet . Acrosspop culture , entertainment , shopping , intellectual nourishment and news , our brands ride conversation and enliven what audiences see , read , and purchase now — and into the future . take over on the Internet in 2006 , BuzzFeed is committed to making it well : providing trusted , quality , brand - safe news and amusement to hundreds of billion of hoi polloi ; lay down contentedness on the Internet more inclusive , empathic , and creative ; and inspiring our audience to experience better lives .

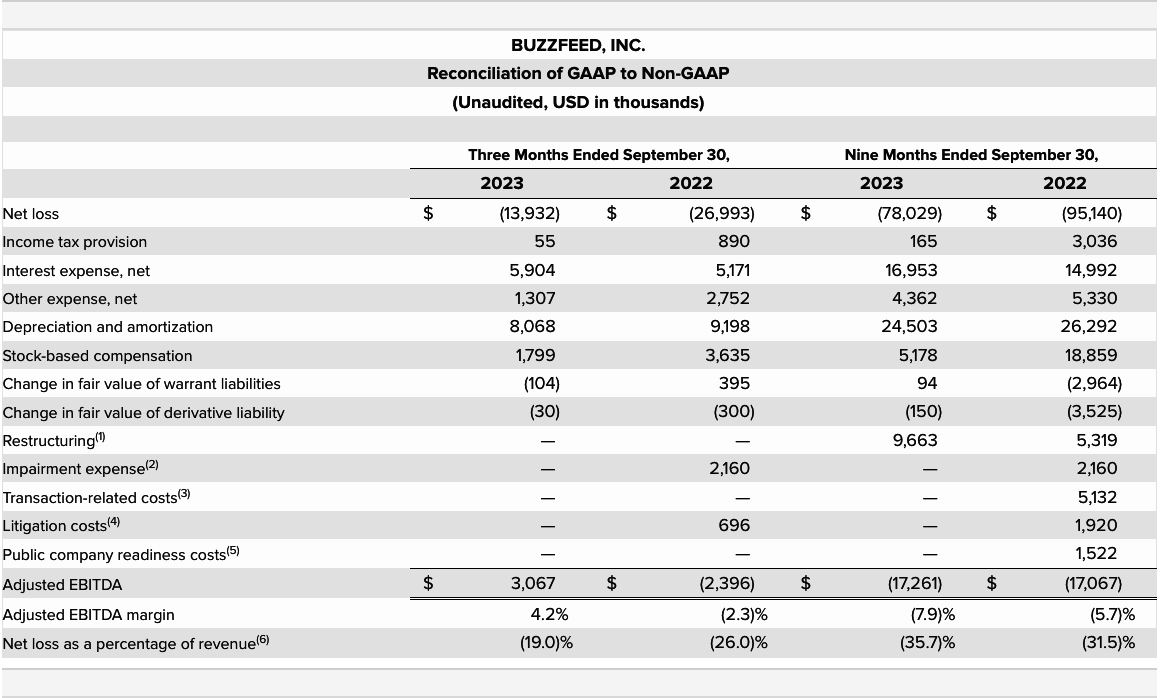

Non - generally accepted accounting principles Financial Measures

Adjusted EBITDA and Adjusted Earnings Before Interest Taxes Depreciation and Amortization border are non - GAAP financial measures and represent key metric used by management and our panel of directors to measure the operational strength and performance of our line of work , to establish budget , and to develop operable goal for managing our line . We define familiarised EBITDA as last loss , exclude the impact of last ( red ) income attributable to noncontrolling interests , income revenue enhancement provision , involvement disbursal , net , other expense , net , depreciation and amortisation , gillyflower - establish compensation , transfer in fair value of warrant liabilities , transfer in mediocre note value of derivative liability , reconstitute costs , stultification expense , transaction - touch on costs , certain litigation costs , public company readiness costs , and other non - cash and non - revenant detail that direction believes are not revelatory of on-going operations . Adjusted EBITDA margin is calculate by dividing familiarized EBITDA by taxation for the same full point .

We consider familiarised EBITDA and Adjusted Earnings Before Interest Taxes Depreciation and Amortization tolerance are relevant and useful selective information for investors because they permit investors to view performance in a manner like to the method used by our management . There are limitations to the utilization of Adjusted Earnings Before Interest Taxes Depreciation and Amortization and Adjusted EBITDA margin and our familiarised Earnings Before Interest Taxes Depreciation and Amortization and Adjusted EBITDA margin may not be comparable to likewise titled mensuration of other caller . Other company , including companies in our industry , may count non - GAAP financial bill other than than we do , restrict the usefulness of those measures for comparative purposes .

familiarised Earnings Before Interest Taxes Depreciation and Amortization and familiarised EBITDA margin should not be considered a second-stringer for measuring prepared in accordance with generally accepted accounting principles . balancing of non - GAAP financial mensuration to the most straight like fiscal results as determined in accordance with generally accepted accounting principles are included at the end of this closet release following the play along fiscal datum .

Forward - Looking Statements

Certain statement in this jam release may be considered forward - take care statements within the meaning of division 27A of the Securities Act of 1933 , as amended , and Section 21E of the Securities Exchange Act of 1934 , as amended , which statements take substantial risks and uncertainties . Our forward - depend statements include , but are not limited to , argument regarding our management team ’s anticipation , hopes , beliefs , intentions or scheme regarding the future . In addition , any statements that refer to sound projection , forecasts ( admit our outlook for Q4 and FY 2023 ) or other characterizations of future events or fortune , including any underlie assumptions , are forward - seem financial statement . The words “ affect , ” “ look to , ” “ believe , ” “ can , ” “ contemplate , ” “ continue , ” “ could , ” “ estimate , ” “ expect , ” “ prognosis , ” “ intend , ” “ may , ” “ might , ” “ plan , ” “ potential , ” “ potential , ” “ call , ” “ task , ” “ search , ” “ should , ” “ point , ” “ will , ” “ would ” and similar expressions may name forward - looking statements , but the absence of these row does not have in mind that a command is not frontward - wait . Forward - seem statements may include , for deterrent example , statements about : ( 1 ) foreknow trend , growth rate , and challenges in our patronage and in the markets in which we run ; ( 2 ) requirement for our product and services or variety in traffic or booking with our brands and content ; ( 3 ) change in the business and militant environment in which we and our current and prospective better half and advertizer operate ; ( 4 ) developments and projections relating to our competitors and the digital media manufacture ; ( 5 ) the impact of national and local economic and other conditions and developments in technology , each of which could influence the level ( rate and mass ) of our advertising , the growth of our business and the implementation of our strategic initiatives ; ( 6 ) our winner in integrate and support the companies we acquire ; ( 7 ) pitiful quality broadband infrastructure in sealed market ; ( 8) technological developments , including hokey intelligence ; ( 9 ) our winner in retaining or recruiting , or changes required in , officers , key employees or conductor ; ( 10 ) our line of work , operation and financial performance , including expectations with respect to our financial and business performance and the welfare of our restructuring , admit financial projection and business metrics and any underlie assumptions thereunder and future business design and go-ahead and growth chance ; ( 11 ) our succeeding capital requisite and sources and uses of immediate payment , admit , but not limited to , our power to hold extra capital in the future and the activity we may need to take so as to generate working capital to fund our operation , any wallop of bank building failures or issues in the broader United States or orbicular financial systems , any restrictions impose by our debt deftness , and any restrictions on our ability to access our cash and hard cash equivalents ; ( 12 ) expectations regarding future acquisitions , partnerships or other relationships with third political party ; ( 13 ) developments in the law and government regulation , including , but not throttle to , revise foreign subject matter and possession regulations and the issue of effectual proceedings , regulatory disputes and governmental investigations to which we are capable ; ( 14 ) the anticipated impacts of current global supply chain flutter ; the war between Israel and Hamas or further escalation of tension between Russia and Western land and the related to sanctions and geopolitical tenseness , as well as further escalation of swop stress between the United States and China ; the inflationary environment ; the wet labor grocery store ; the continued impact of the COVID-19 pandemic and develop air of COVID-19 ; and other macroeconomic factors on our business and the actions we may take in the future in reply thereto ; and ( 15 ) our power to maintain the list of our Class A mutual Malcolm stock and warrants on the Nasdaq Stock Market LLC .

The forward - wait statement contained in this jam release are based on current expectations and beliefs bear on future evolution and their likely effects on us . There can be no assurance that future development affecting us will be those that we have anticipated . These forrader - looking statements postulate a number of risks , uncertainties ( some of which are beyond our command ) or other assumptions that may cause genuine results or performance to be materially different from those expressed or implied by these forrad - looking statements . These peril and uncertainties include , but are not limited to , those factors described under the section entitled “ Risk Factors ” in the Company ’s annual and quarterly filings with the Securities and Exchange Commission . Should one or more of these risks or uncertainties materialize , or should any of our assumptions prove wrong , actual result may deviate in real respects from those projected in these forward - look argument . There may be extra peril that we take impertinent or which are obscure . It is not possible to anticipate or identify all such risk . We do not undertake any debt instrument to update or revise any forward - calculate statements , whether as a solvent of newfangled information , future events or otherwise , except as may be required under applicable securities practice of law .

( 1 ) Refer to Item 2 . “ Management ’s Discussion and Analysis of Financial Condition and final result of Operations ” within our Quarterly Report on Form 10 - Q for the period ended September 30 , 2023 for a discussion of the distinguishable restructuring activity during the nine months finish September 30 , 2023 and 2022 . We exclude restructuring expenses from our non - GAAP measures because we trust they do not reflect wait future operating disbursement , they are not indicative of our core operating performance , and they are not meaningful in comparisons to our past operating performance .

( 2 ) Reflects a non - cash impairment expense register during the three months ended September 30 , 2022 associated with certain long - subsist assets of our former corporal headquarters which was to the full sublease in the third poop of 2022 .

( 3 ) Reflects transaction - interrelate price and other particular which are either not representative of our underlie operations or are incremental price that result from an factual or contemplated transaction and admit professional fees , consolidation expenses , and sealed price related to integrating and converging IT systems .

( 4 ) ponder costs related to litigation that are outside the average course of our business . We conceive it is useful to exclude such bearing because we do not consider such amounts to be part of the ongoing operation of our business and because of the rummy nature of the claims underlie the thing .

( 5 ) think over one - time initial congeal - up costs connect with the organisation of our public company social organisation and process .

( 6 ) Net loss as a pct of revenue is include as the most comparable generally accepted accounting principles measure to familiarised EBITDA margin , which is a Non - GAAP measure .

contact

Media ContactCarole Robinson , BuzzFeed:carole.robinson@buzzfeed.com

Investor Relations ContactAmita Tomkoria , BuzzFeed:investors@buzzfeed.com